35+ Bridging loan how much can i borrow

Although the maximum amount you can borrow with loan is 20000 this is not a guarantee that you will be able to take out that much your personal financial information will also affect just how much a lender is willing to loan you. However a loan term extension is only possible if your current home loan tenure is not maxed out.

Combining Taxable Rd Gnma Loans With Tax Exempt Bonds And 4 Tax Credits June Ppt Download

College loans in Illinois can be refinanced at low interest rates by the Illinois Treasurers Office under the Illinois Student Loan Investment Act passed in 2019.

. For example if you are 25 years old now and buying a freehold property the maximum loan period is 35 years. A bridging loan can help you bridge the gap if you want to buy a new home before selling your current one. Theyre also usually paid back over a fairly long term often between five and 25 years.

A mortgage is a loan to buy a property or land. Small commercial mortgages will usually have a higher interest rate. You need to make sure you can afford repayments not just now but years in the future.

Loan-To-Value Limits The loan-to-value LTV limit determines the maximum amount an individual can borrow from a financial institution FI for a housing loan. This is because of the costs of running the mortgage account a higher interest rate maybe required on a small facility in order to cover the costs involved and for the lender to make a profit. The Bureau of Labor Statistics OEWS program requires that occupational employment and wage estimates meet the following criteria before they can be published.

This is because you can secure a bridging loan across more than one property. No arrangement or set up fee. 435 35 reviews 435 35 reviews Featured Reviews Perfect city apartment.

We can handle your term paper dissertation a research proposal or an essay on any topic. In Scotland your loan will be cancelled when you reach 65 if it was taken out in 20062007 or before. Discover the best easy access and fixed ISA rates today.

As long as the LTV is 75 or below based on the combined value of properties being used as security then. Whenever students face academic hardships they tend to run to online essay help companies. The number of years youve served your current loan will also be deducted from your extended maximum loan tenure.

Reviewed Sep 2021 by Lydia C. Your income also influences the amount you can borrow. Loan to value LTV calculator.

The larger the loan then generally this may mean a lower interest rate. Our experienced journalists want to glorify God in what we do. How much could I borrow with a homeowner loan.

Find out how much you can earn in savings interest before paying. This is the loophole that some lenders have been using recently to lend up to 6 times salary for some specific categories of mortgage borrowers including first-time buyers. Homeowners in Singapore seek home loan refinancing for three major reasons.

How much of my equity can I borrow. Some 17 of the states. Borrow from 1000 to 20000.

Most lenders will lend you up to 80 of your propertys value. Compare bridging loans today and find the right deal for you. Compare the entire UK market quickly and easily using just one table.

Whenever students face academic hardships they tend to run to online essay help companies. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Its usually taken out over 25 or more years and the loan plus interest is paid off each month.

We can handle your term paper dissertation a research proposal or an essay on any topic. If this is also happening to you you can message us at course help online. In the late 1980s a high school graduate who wanted to attend college or university was looking at average tuition of 15160 per year for a private nonprofit school and 3190 per year for a.

3 Benefits of Refinancing Your Home Loan. Homeowner loans tend to be used by people who need to borrow larger sums of money typically between 10000 and 500000. For non-EUEFTA nationals the LTV rate is usually 50-75.

Start your comparison with Moneyfactscouk. But our partner Fluent asks that you have at least 35 equity. How much can I borrow calculator.

The number of homeowner mortgages they can offer at a higher loan to income ratio LTI is capped at an average 15 per quarter. For example if an individual borrows 800000 to purchase a property valued at 1000000 the LTV is 80. Repayment periods of 1 to 5 years.

Up to 35 years or 75 years of age whichever is earlier. If this is also happening to you you can message us at course help online. Start your comparison journey today.

LTV refers to the loan amount as a percentage of the propertys value. However French citizens and permanent residents can sometimes borrow up to 100 usually with the proviso that a percentage of this is placed in a savings account with a French bank. Plan 2 - if you took out your loan after the 1st September 2012 debt will usually be written off 30 years after you became eligible to pay it back.

We will ensure we give you a high quality content that will give you a good grade. Visit Money Guru to compare loans credit cards mortgages current accounts business accounts and savings. If it was taken out in 20072008 or after it will be 35 years after you started to repay it.

In some situations it is possible to borrow 100 of a propertys value with a bridging loan. Some will go up to 90 or even 95 but an 80 limit is far more common. Redcliff Quarter by A2Dominion Rental Only BS1.

Choosing the right mortgage is one of the most important financial decisions youll ever make. The loan duration plus the age of the applicant must be less than or equal to 75 years. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

HomeViews collects verified resident reviews for new build homes across the UK so you can make an informed decision. Occupational employment of at least 10 and more than 01 of total employment in the appropriate areaNAICS cell. But this means theres a limit to how much you can borrow usually up to 25000.

So in order to raise the full amount needed to buy the property we need to borrow money through a mortgage. Can I borrow 100 LTV with a bridging loan. The term of a mortgage usually lasts between 25 and 35 years.

We will ensure we give you a high quality content that will give you a good grade. A mortgage is an arrangement where you borrow money from a lender to buy a property whether as a home or investment such as a buy-to-let.

Combining Taxable Rd Gnma Loans With Tax Exempt Bonds And 4 Tax Credits June Ppt Download

Get Home Loan In California Rcd Capital In 2022 Home Loans Refinance Loans Loan

Combining Taxable Rdgnma Loans With Tax Exempt Bonds

Hank Zarihs Associates Are Experienced Financial Intermediaries Specializing In Development And Investment Funding L Development Finance Real Estate Marketing

Free 10 Loan And Security Agreement Templates In Ms Word Pdf Free Premium Templates

Combining Taxable Rd Gnma Loans With Tax Exempt Bonds And 4 Tax Credits June Ppt Download

Combining Taxable Rdgnma Loans With Tax Exempt Bonds

10 Things I Ve Learned Designing For Decentralised Finance Defi In 2022 Learning Design Use Case Blockchain Technology

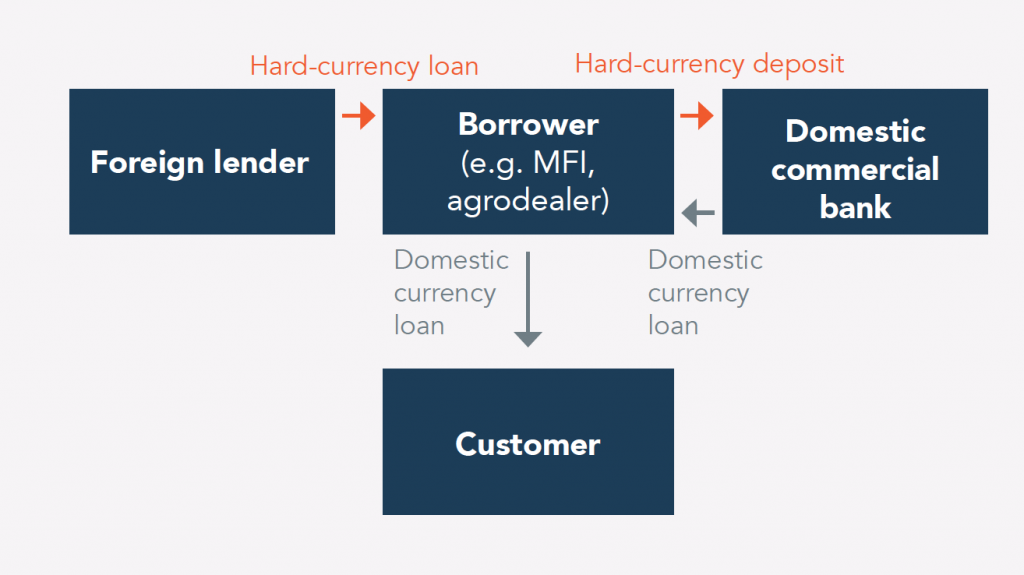

Managing Currency Risk In Africa A Playbook For Decision Making Orbitt

2

11 Mortgage Lender Templates In Pdf Doc Free Premium Templates

Fund Your Higher Education With A Student S Loan Education Higher Education Study

Money Vector Illustration Canadian Money Money Goals Vector Illustration

Faq Normandy Corporation Licensed Mortgage Banker

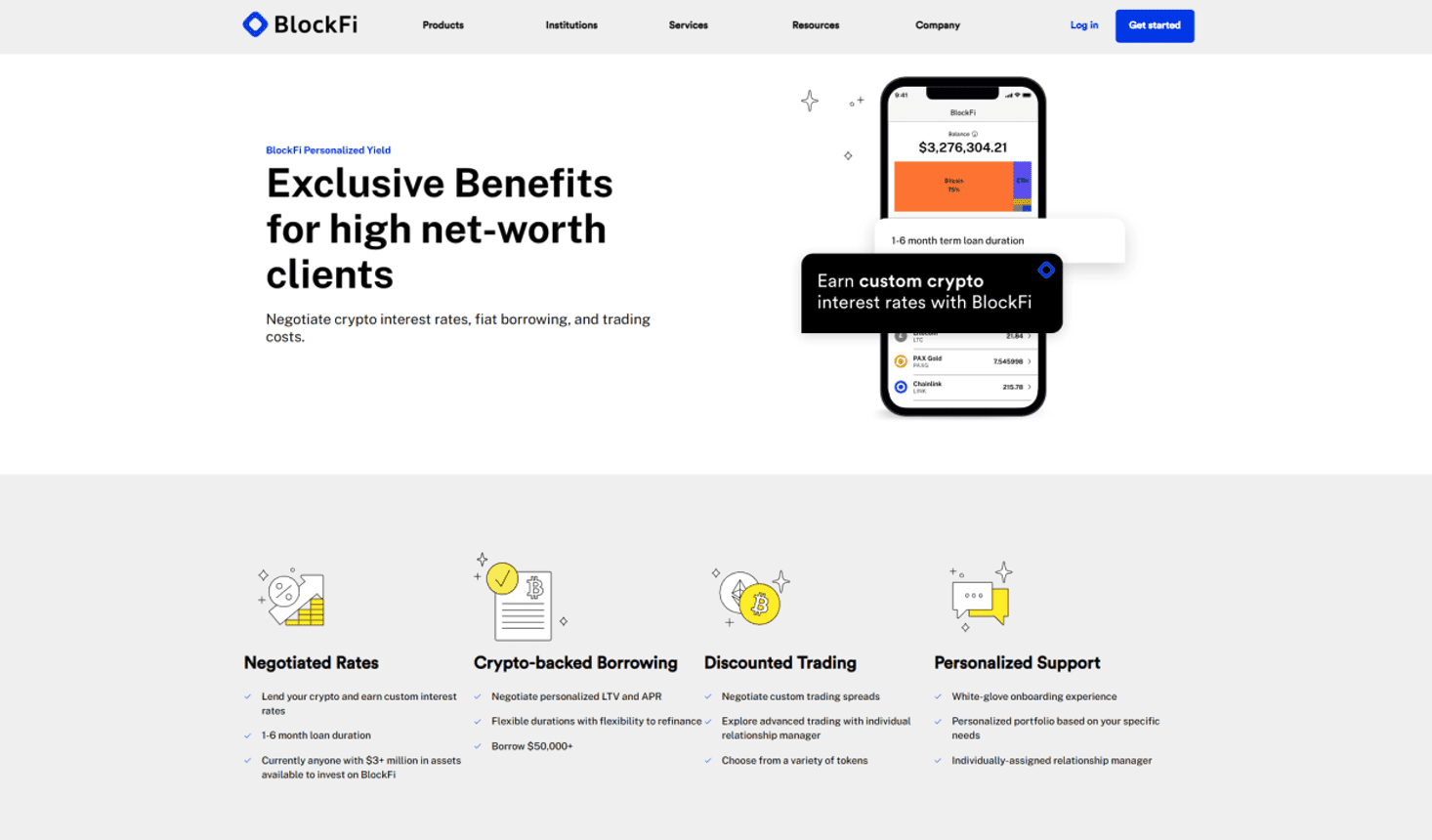

Blockfi Review 2022 Pros Cons And Features Marketplace Fairness

50 Best Timesheet Payroll Memes Memes Payroll Finance

Blockfi Review 2022 Pros Cons And Features Marketplace Fairness